1.2 Hafnia: A Year in Review

2023 Market Outlook

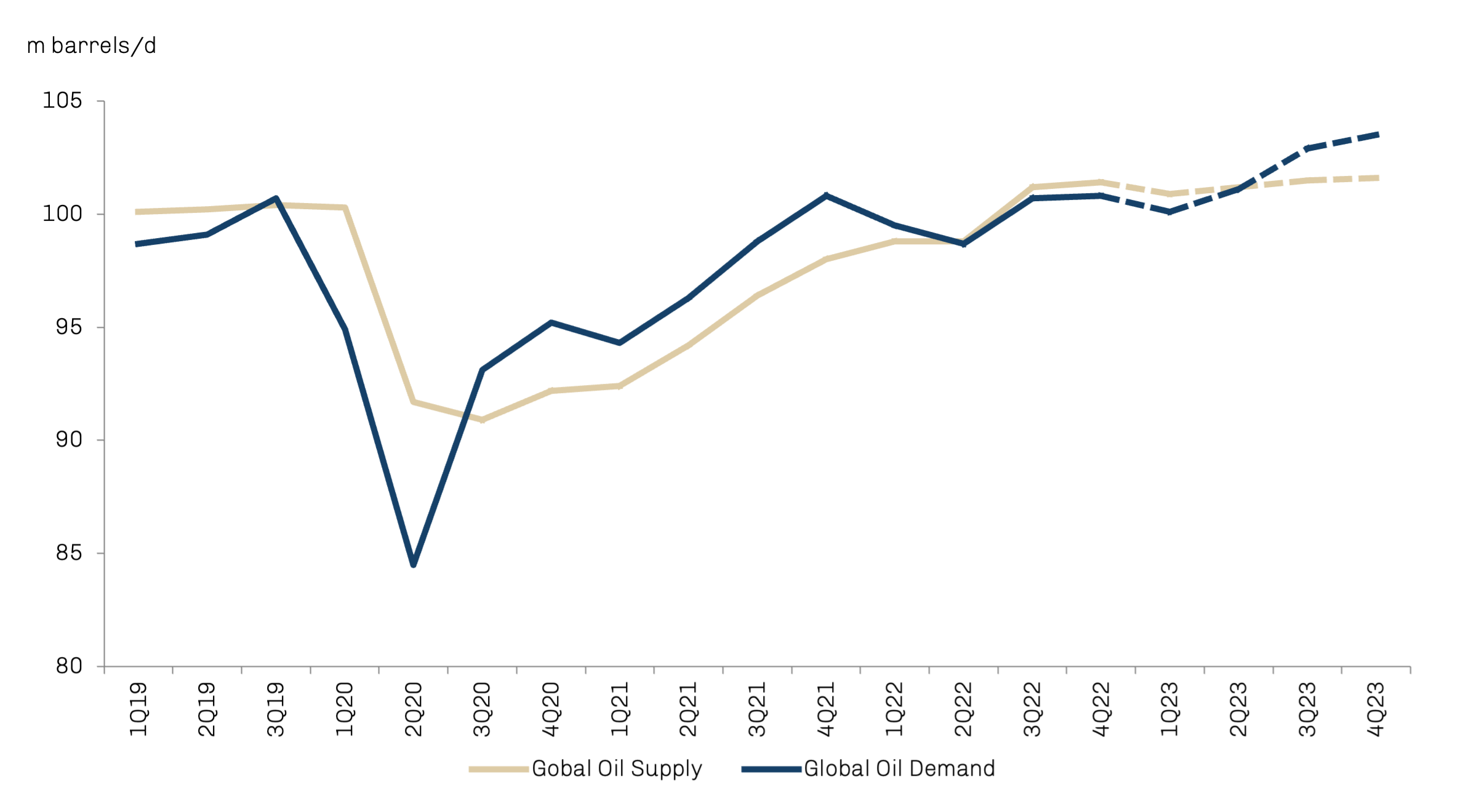

Estimated global oil supply and demand

Source: Clarksons Research, March 2023

The product tanker market outlook generally appears very encouraging, with several factors driving positive trends on the demand side and limited supply growth expected. Seaborne product trade volumes are expected to continue to expand in 2023, largely driven by increasing exports from the Middle East, Asia and US.

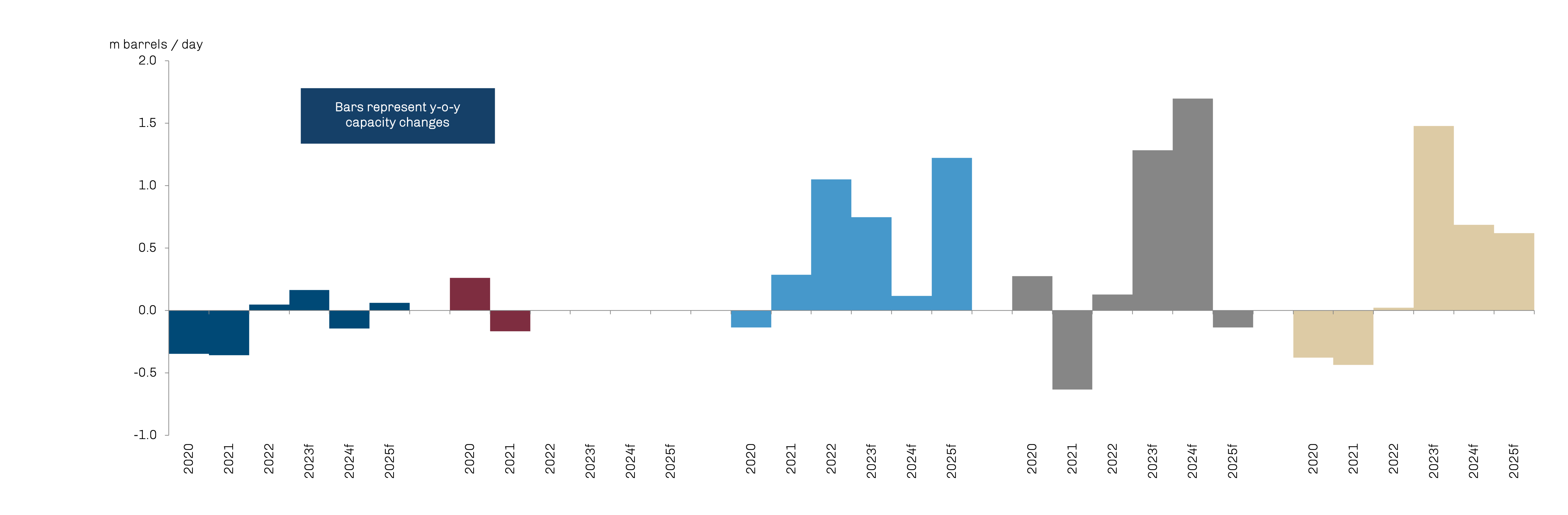

In the Middle East, further expansion in refinery capacity and ramp-up of throughput at recent start-ups is expected (e.g. in Kuwait, Saudi Arabia, Oman, Bahrain, Iraq). This will support the clean product segment due to increased export volumes, and long-haul transport and demand from end users.

Asian growth is expected to be driven by a range of countries, notably India and China, where refinery capacity is continuing to expand, and Malaysia, where shipments are growing after recent startups. Chinese export licenses of the fourth quarter 2022 have been on a record high, adding about 1.0m barrels of increased transport demand to the worldwide balance.

Regional refinery capacity growth

Source: Clarksons Research, March 2023

For the first quarter of 2023, the Chinese government has announced export licenses close to the fourth quarter volumes last year. However, a swift recovery of the Chinese economy and oil demand, and increased upstream demand, will leave export volumes inferior to the fourth quarter 2022.

In the U.S., shipments are projected to continue to increase, though exports have seen some disruption in early 2023 from severe weather and increased refinery maintenance. Following the introduction of the EU’s ban on product imports from Russia in early February, a significant shift in seaborne products trade flows is also materialising, providing additional support to product tanker demand.

Before February 5th, Russia’s clean products exports into Europe were gradually decreasing from about 1.0m barrels/day to around 0.7m barrels/day. We have seen Russia’s export volumes to Europe disappear after February 5th and the above said 0.7m barrels, will have to flow into other regions. Although uncertainty remains over the precise impact of the ban on total Russian products exports, initial indications suggest that Russia is increasing shipments to alternative, further afield destinations, including the Middle East, Latin America, Asia and Africa.

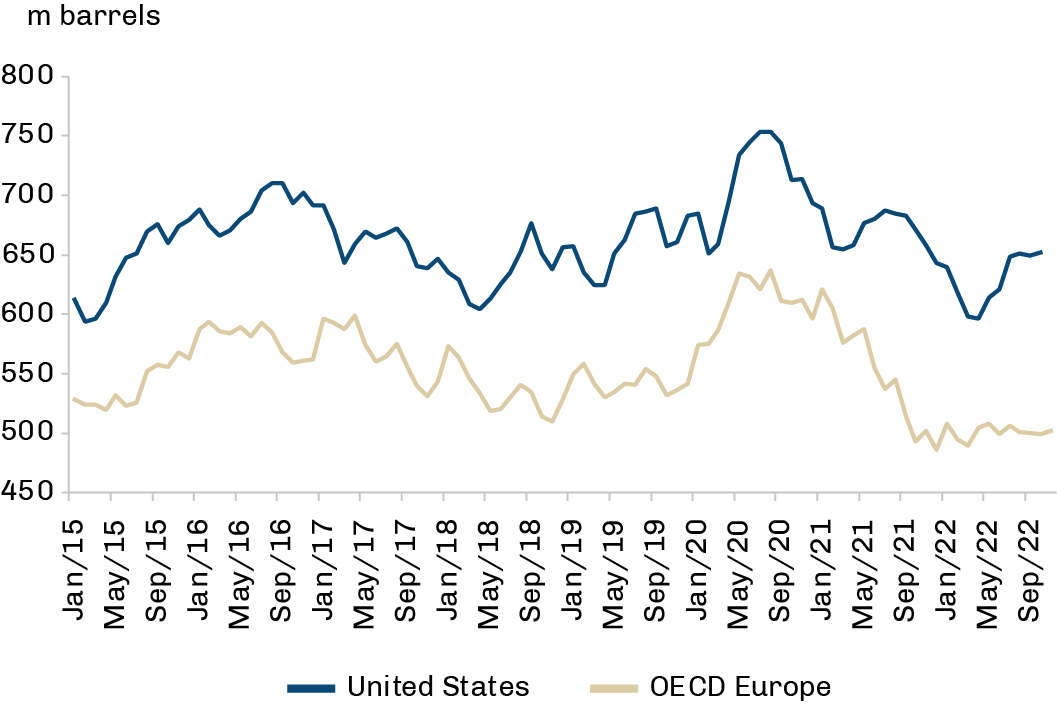

Regional oil product inventories

Source: IEA, March 2023

While high European stockpiles of Russian and other products may limit the increase in longerhaul imports into Europe in the immediate term, a trend towards increased longer-haul European imports from areas further away such as the Middle East, US and Asia is still expected through 2023.

Low inventories and the opening and closure of refineries around the world is expected to continue to shift trade flows. Product imports into Europe and Australia are expected to rise further following recent refinery closures. Inventories for clean products in the West remain below the long-term average, while levels in the East are on par. With the start-up of significant volumes in new refinery capacity in the Middle East, we can expect clean trade volumes to increase to replenish this drop. Overall, initial estimates suggest potential for strong growth in global products tonne-mile trade of over 10% in 2023. Impacts from the EU ban on imports from Russia may also contribute to increased inefficiencies in the market, absorbing tonnage.

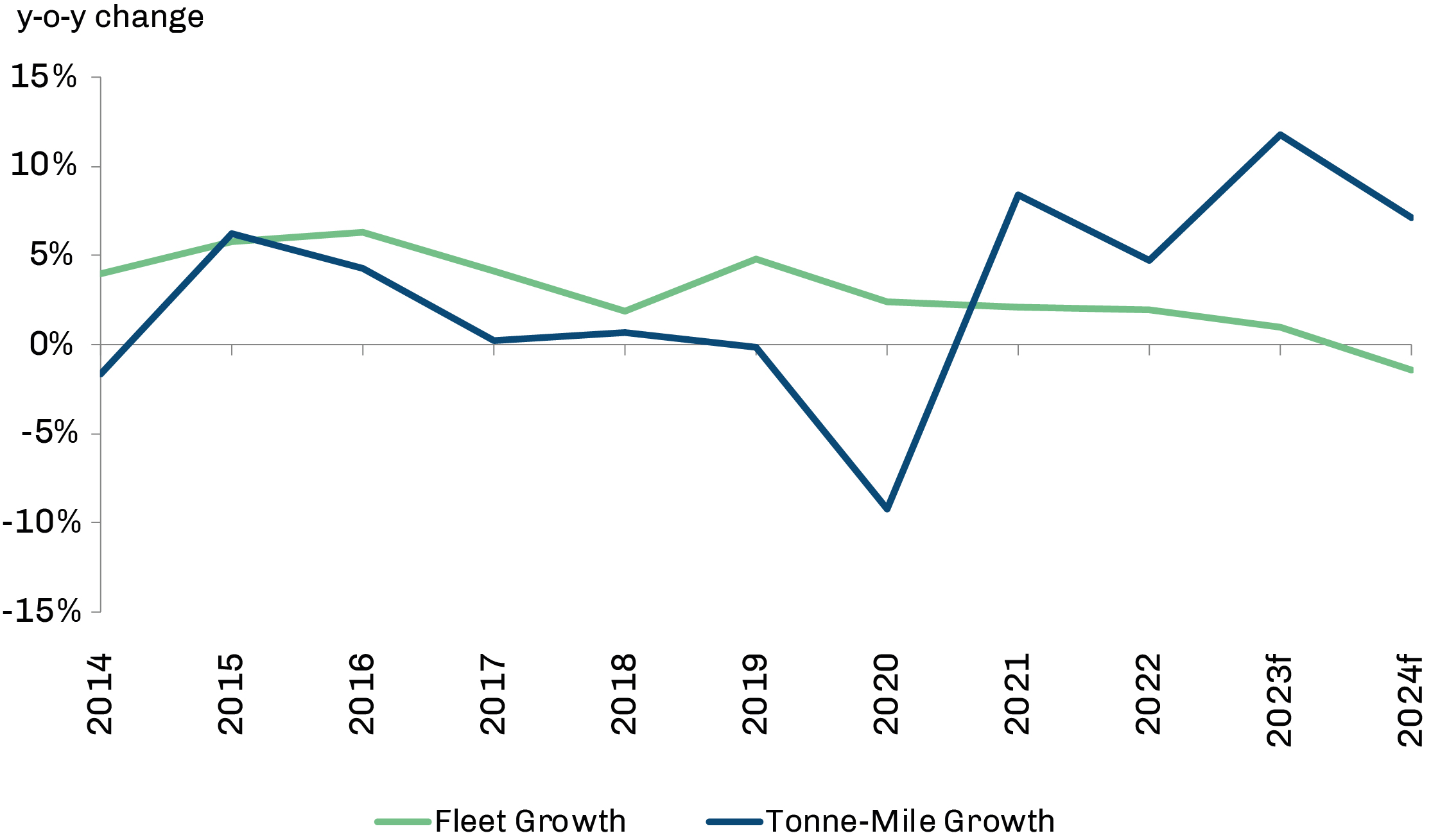

The supply backdrop appears supportive, following limited newbuild ordering in recent years. The Product tanker fleet growth is currently projected to remain subdued this year at approximately 1%, with deliveries projected to ease down further from the 2022 level to less than 5m DWT. Impact from new emissions regulations are also expected to have a further moderating impact on active tanker supply.

Product tanker supply and demand

Source: Clarksons Research, March 2023

Uncertainty remains and scenarios vary, but Clarksons Research estimates suggest that compliance with the Energy Efficiency eXisting ship Index (EEXI) and the Carbon Intensity Indicator (CII) could reduce available supply across the tanker sector by an average of 1.5-2.0% annually across 2023-24, through slower speeds and retrofit time.

Overall, while there remain some risks to the outlook, including global economic headwinds and uncertainty over the outlook for Russian exports, underlying trends in refinery capacity and expected shifts towards longer-haul routes suggest that product tanker markets are likely to remain tight through 2023, even if some volatility continues to be seen.

Initial indication for 2024 also appear supportive,with preliminary projections suggesting anotherstrong year for products tonne-mile trade growth of approximately 7%, whilst supply side growth looks likely to remain very limited given the orderbook schedule. Impacts on active supply from new environmental regulations, including potentially slower speeds, are also expected to continue.