1.2 Hafnia: A Year in Review

The Product

Tanker Market

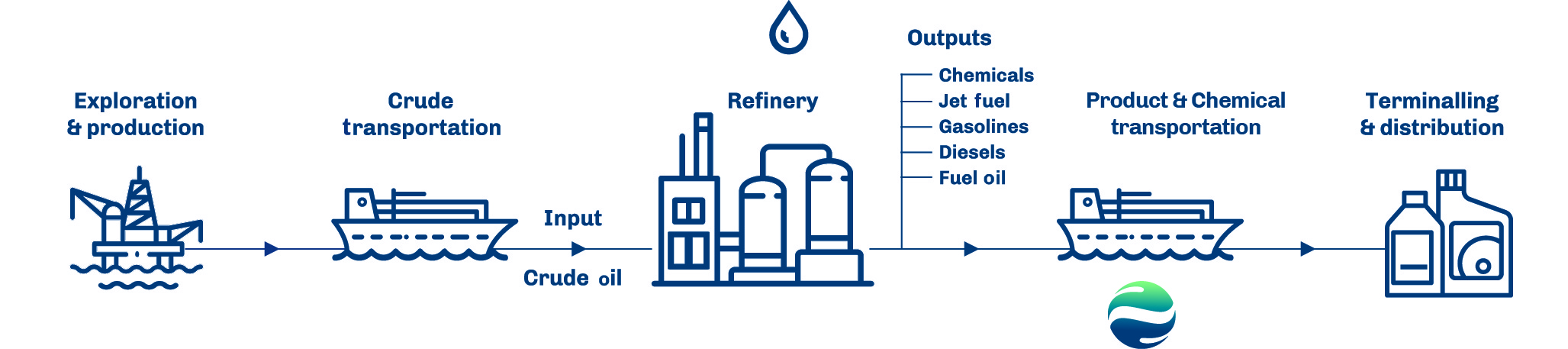

Hafnia primarily operates in the worldwide transportation of refined oil products and chemicals, which is shown in the simplified tanker market overview below. The product tanker market is cyclical and volatile, and the charter rates and product tanker capacities depend on several factors:

- Number of newbuilds and the number of vessels being scrapped

- Oil demand and refinery throughput

- Price of oil

- Oil inventories

- Environmental regulations

- Geopolitics and sanctions

- Location of refineries

The charter market is also highly competitive and based primarily on the offered charter rate, vessel’s location, technical specification, and the reputation of its manager. Crude tankers transport crude oil from points of

production to oil refineries or storage locations. Product tankers, which have a special lining in the tank, can carry both refined and unrefined products, including crude oil, fuel oil, vacuum gas oil (dirty products), and gas oil, gasoline, jet fuel, kerosene and naphtha (clean products) as well as edible oils and very light chemical cargo grades. Product tankers trade primarily on routes following main import and export patterns for fuels, which is largely driven by regional refining differences.

Chemical tankers can, in addition to product tankers, carry a wider range of chemicals, such as methanol, ethanol, styrene monomer, benzene, xylenes, hexenes and renewable oils with higher content of free fatty acids (e.g. used cooking oil). Freight rates for a vessel trading under spot charters are susceptible to fluctuating demand and supply of vessels, resulting in high volatility. Rates are also strongly affected by seasonal fluctuations in demand from end consumers, global oil demand

and inventories. Product tankers are typically dedicated to trading clean petroleum or dirty petroleum products. Clean tonnage supply can increase at times when clean trading earnings are significantly higher than dirty trading earnings as it will attract dirty tankers to clean up their tanks to clean petroleum products. This is a costly process which is not done easily.

A concept typically used to depict earnings in shipping is ‘time charter equivalent income’ (TCE). TCE is a standard measure used in the shipping industry for reporting of income, providing improved comparability across different types of charters. TCE represents voyage income less voyage expenses, comprising primarily of fuel bunker expenses, port charges and commissions.

Another key concept used to depict output in shipping is called ‘tonne-mile’. A tonne-mile is defined as one tonne of cargo transported one nautical mile, and an increase in this value represents higher cargo volume transported.

Key highlights

- Product tanker markets experienced exceptionally firm earnings and tight market conditions, with all-time high charter rates reported

in 2022 - Strong demand for product tankers has developed, with increased refinery runs and increased tonne-mile trade driven by redistribution of energy trade flows following the Russia-Ukraine conflict • Significant demand growth is expected in 2023 driven by recovery of Chinese economy and oil demand post Covid-19 lockdowns

- Export growth from the Middle East due to completion of two new high complexity refineries in Saudi Arabia and Kuwait supports increasing transport demand from the region

- U.S. refinery runs are expected to remain high, due to growing domestic demand and low strategic inventories, driving export volumes up for the incremental barrel not consumed upstream EU ban on Russian product imports have come into effect, resulting in a shift in trade flows to longer-haul routes

- Tanker supply side remains positive, with limited product tanker fleet growth of only approximately 2% DWT expansion in 2022 and approximately 1% expansion projected in 2023

- The product tanker orderbook reflects 20-year lows at 5% of fleet capacity, and limitations in short-term shipyard capacity due to ordering activity in other shipping segments constrain significant product tankers fleet growth as far out as 2026

- Active tanker supply may be moderated by new and complex emissions regulations (including CII and EEXI) partly through slower speeds and retrofit time

- Despite risks from global economic headwinds and geo-political uncertainty, underlying trends in refinery capacity and shifts towards longerhaul routes suggest that product tanker markets are likely to remain tight but volatile through 2023