1.2 Hafnia: A Year in Review

2022 Market

Summary

Trade & Demand

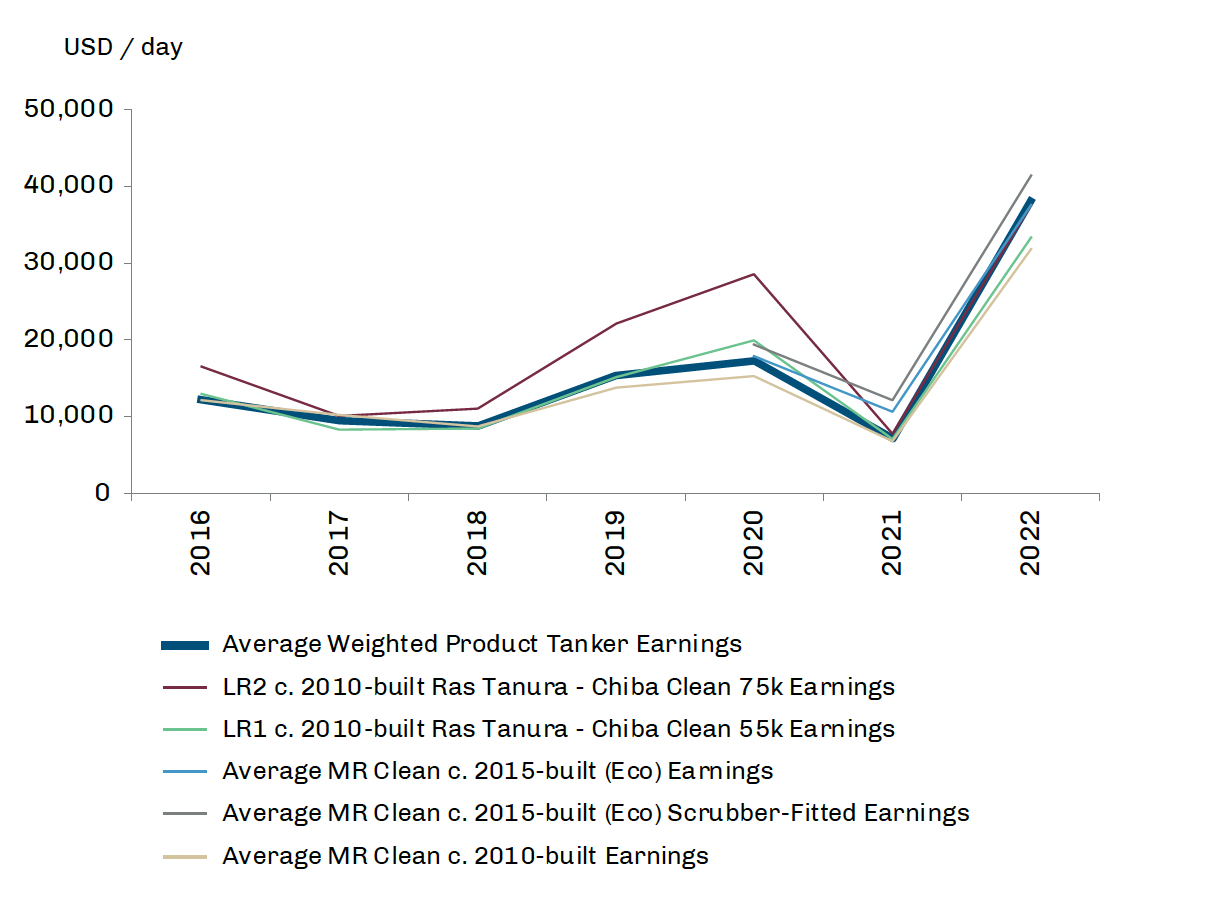

The product tanker market strengthened significantly after the onset of the Russia-Ukraine conflict in early 2022, and has since experienced very firm conditions.

Clarksons Research’s product tanker spot earnings series averaged USD 38,053/day across full year 2022, the highest annual average on record stretching back 25 years, and directly following on from the lowest level on record of USD 7,092/day in 2021 – a year where markets continued to experience pressure from enduring impacts on global oil demand and seaborne oil trade due to the Covid-19 pandemic.

Product tanker earnings strengthened considerably in the second quarter of 2022 after the start of the Ukraine conflict which led to shifts in product trade patterns, improving product tanker utilisation and longer transport distances.

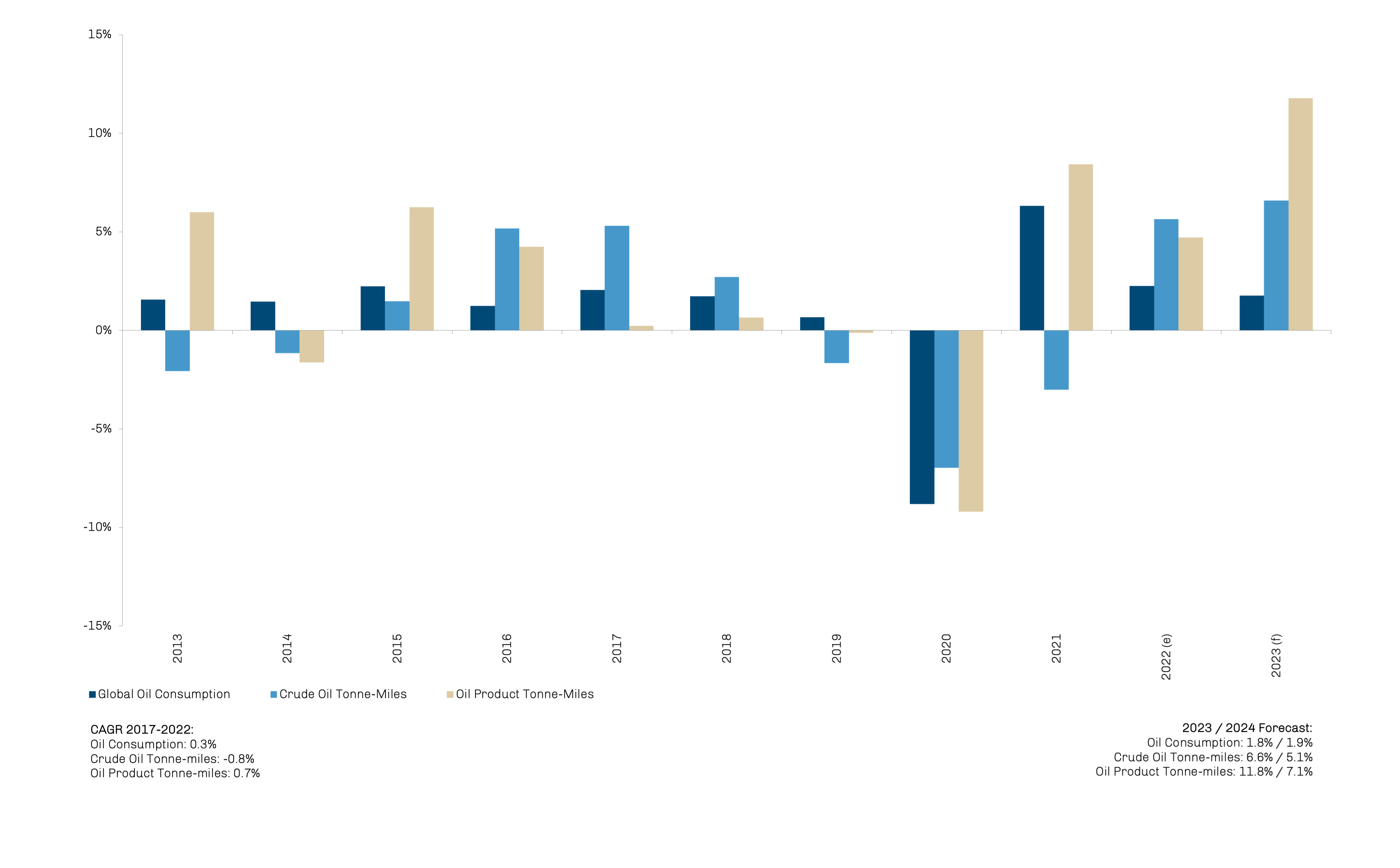

Strong refining margins, increased refinery throughput and the underlying shifts in refinery capacity, combined with record high Russian and Chinese export volumes, have been the main drivers supporting trade volumes and ton-mile gains. The surge in European natural gas price led to a widening gas premium over oil products, causing fuel switching from natural gas to oil products for power generation in Europe, leading to increased oil consumption.

According to Clarksons Research clean MR spot earnings (basis a c.2010-built non scrubber-fitted ship) averaged USD 31,775/day in 2022, the highest level on record.

Earnings premiums for ‘eco’ and scrubber-fitted tonnage also widened in 2022 amid a high bunker price environment, with average earnings for a c.2015-built ‘eco’ ship averaging USD 37,584/day, and earnings for a scrubber-fitted ‘eco’ MR reaching USD 41,353/day.

Earnings in the LR sectors also firmed significantly last year to strong levels. LR2 clean spot earnings on the benchmark Ras Tanura-Chiba route averaged USD 37,514/day in 2022 (basis a c.2010-built non scrubber-fitted ship), up from a low of just USD 7,727/day in 2021. LR1 earnings on the same route averaged USD 33,338/day in 2022.

Source: Clarksons Research, March 2023

Global oil trade volumes – Crude oil

Source: Clarksons Research, March 2023

Global oil trade volumes – Oil Products

Source: Clarksons Research, March 2023

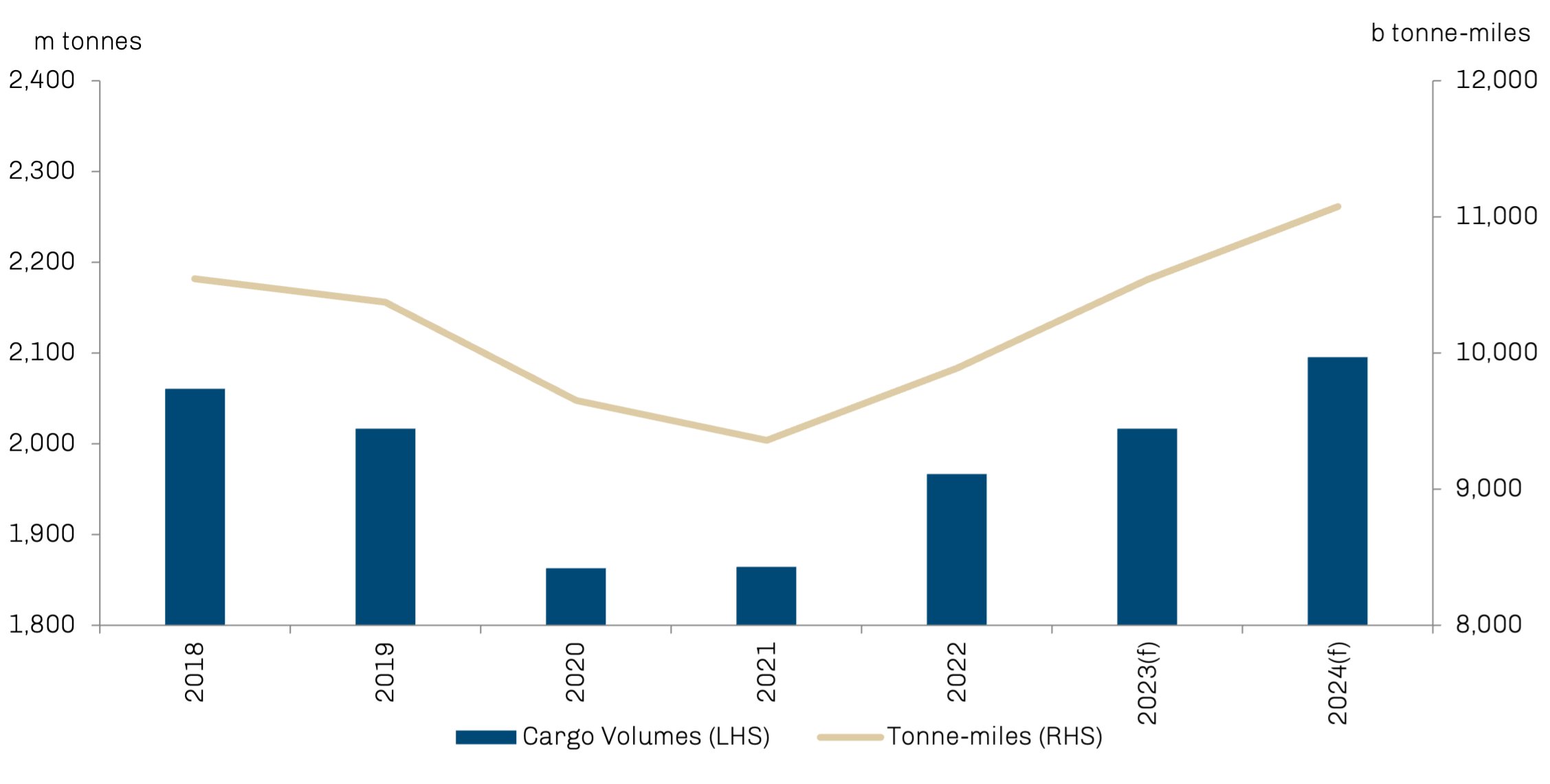

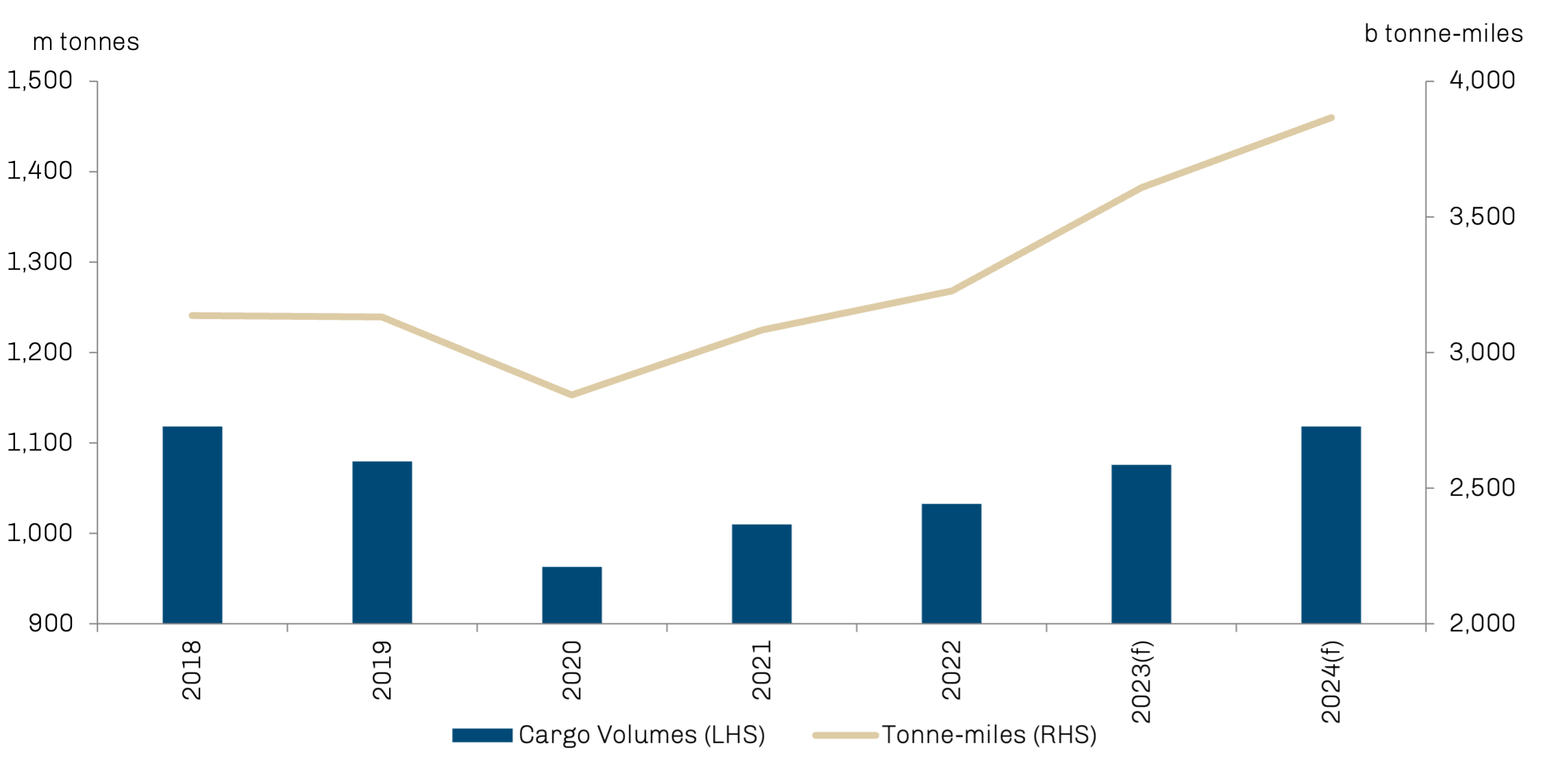

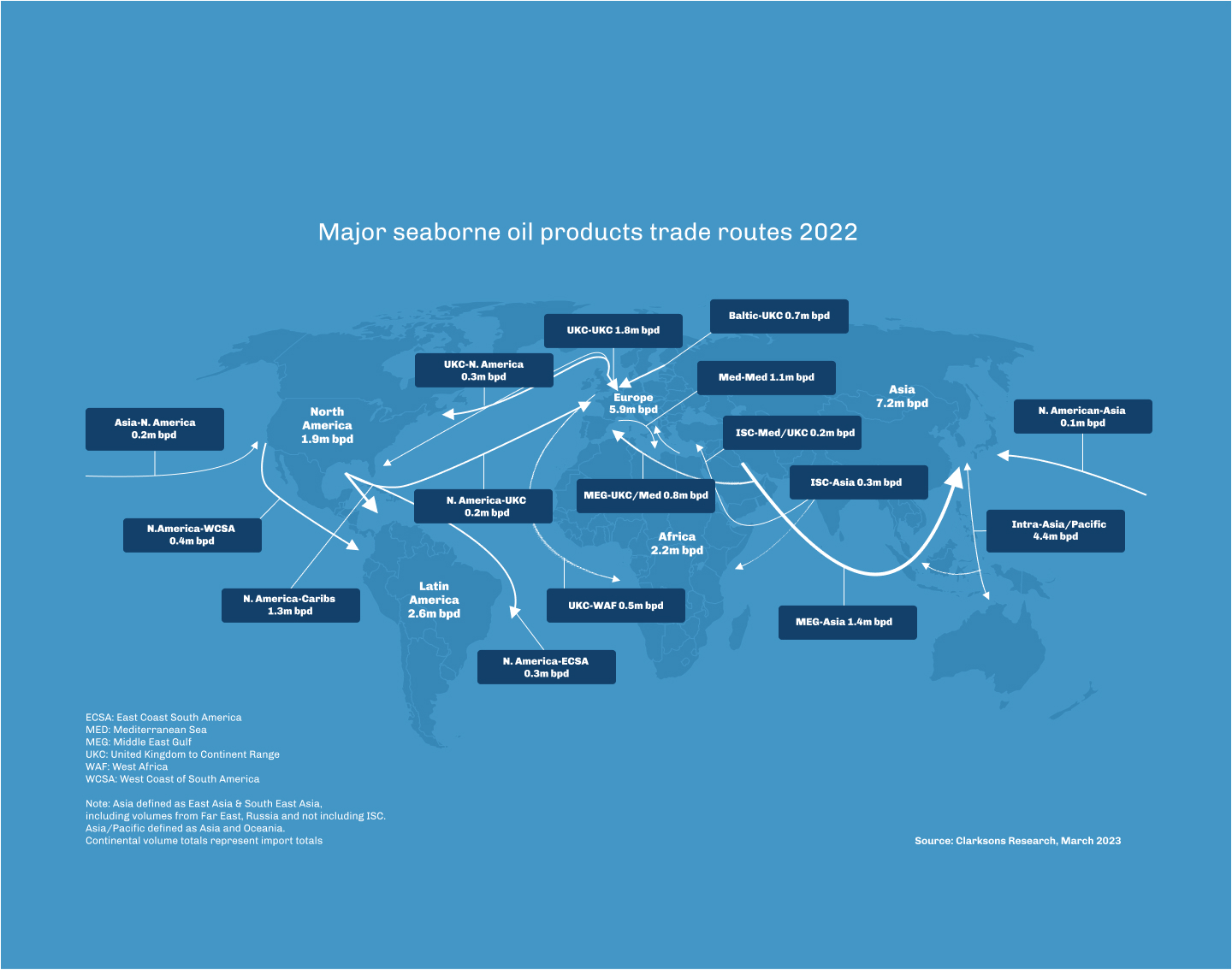

Seaborne products trade volumes increased by an estimated 2% in 2022 to reach 22.2m barrels/day, with growth supported by underlying gains in global oil demand and refinery throughput, as well as expansion in refinery capacity in key regions.

Middle Eastern exports rose by 9% in 2022 to 4.3m barrels/day, on the back of several refinery start-ups, whilst US exports rose by around 10% to 2.7m barrels/ day, largely on the back of strategic inventory releases, rebounding refinery throughput and stronger demand in Latin America. On the imports side, volume gains were generally driven by rebounding oil demand in Latin America, Africa, and Australia, where the recent further closure of approximately 0.25m barrels/day of domestic refinery capacity has boosted products import requirements.

Trade growth in tonne-miles is estimated to have increased by 5% in 2022, reflecting initial shifts in trade patterns related to the Ukraine conflict, refinery capacity changes and other demand trends. In particular, trade grew firmly on some relatively longer-haul routes including Asia-Australasia, Asia-Europe, Middle East to Asia and North America, Russia to India, and Europe to West Africa, whilst lower volumes were recorded on some shorter-haul routes, including Far East Russia to Japan/Korea and Asian exports to China amid Covid-19-related disruption.

World seaborne oil and total consumption growth

Source: Clarksons Research, March 2023

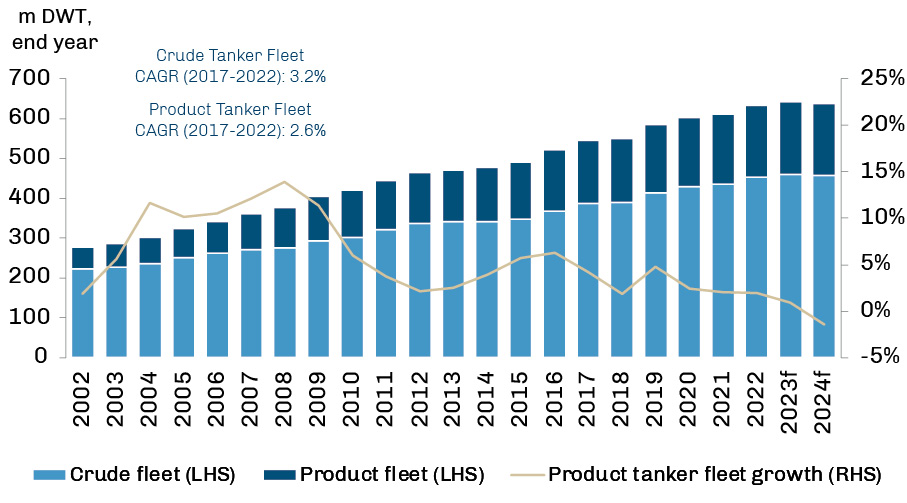

Product tanker fleet growth remained subdued by the end of 2022, with capacity (basis ships 10,000+DWT) expanding by just 2% during 2022 to reach 180.8m DWT. The crude tanker fleet, on the other hand, expanded by 4% to reach 453.1m DWT. Anticipated growth in oil demand and longer trading routes will pave the way for higher utilisation of the existing product tanker fleet.

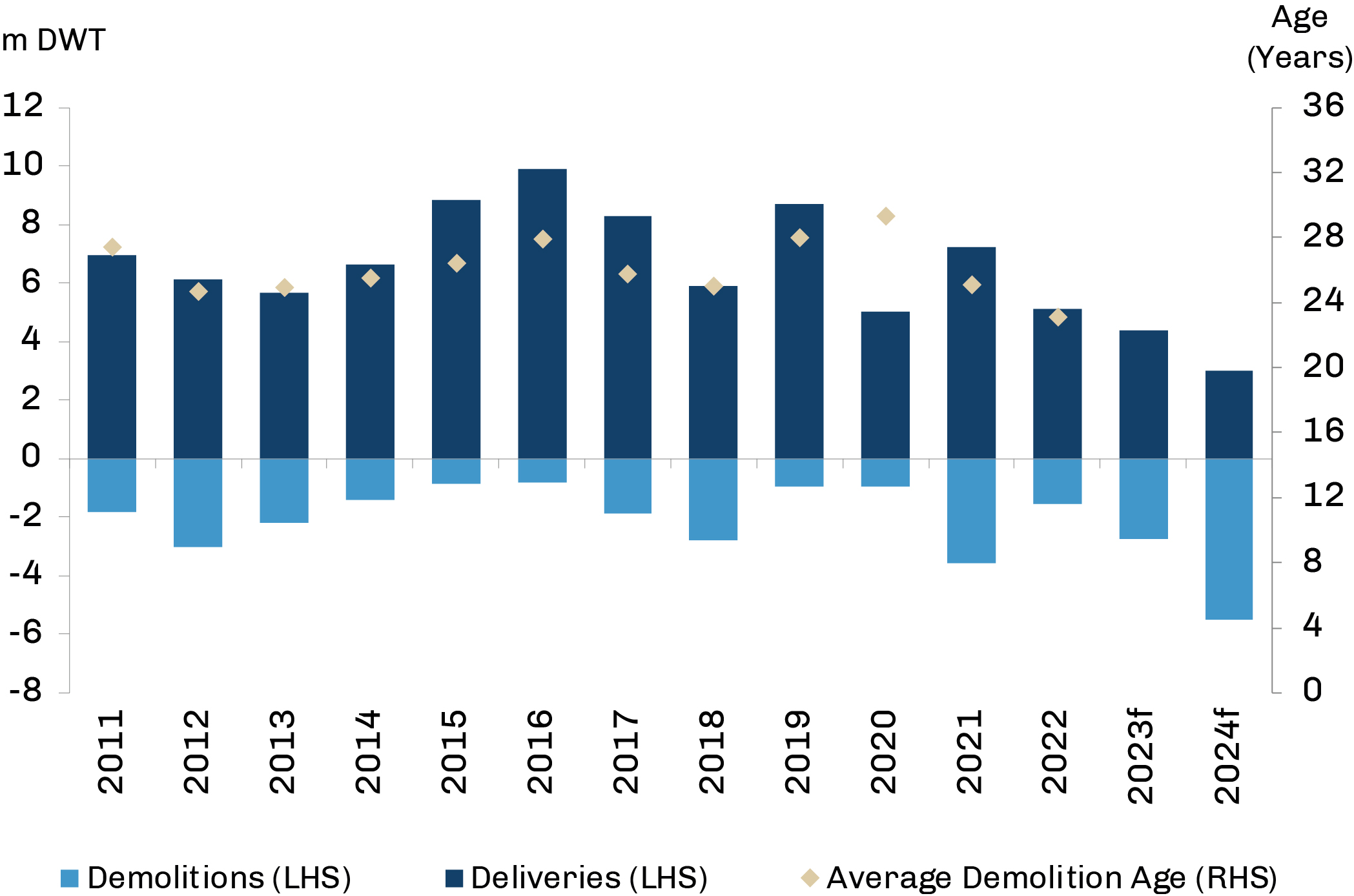

This muted product fleet development is largely attributed to a low level of deliveries in 2022, with total product tanker deliveries falling by 29% year-on-year to a limited 5.1m DWT.

Meanwhile, and despite a high scrap price environment, recycling was generally limited with only 1.5m DWT sold for recycling in 2022, compared to 3.6m DWT in 2021.

Product & crude tanker fleet development

Source: Clarksons Research, March 2023

Product tanker fleet changes

Source: Clarksons Research, March 2023

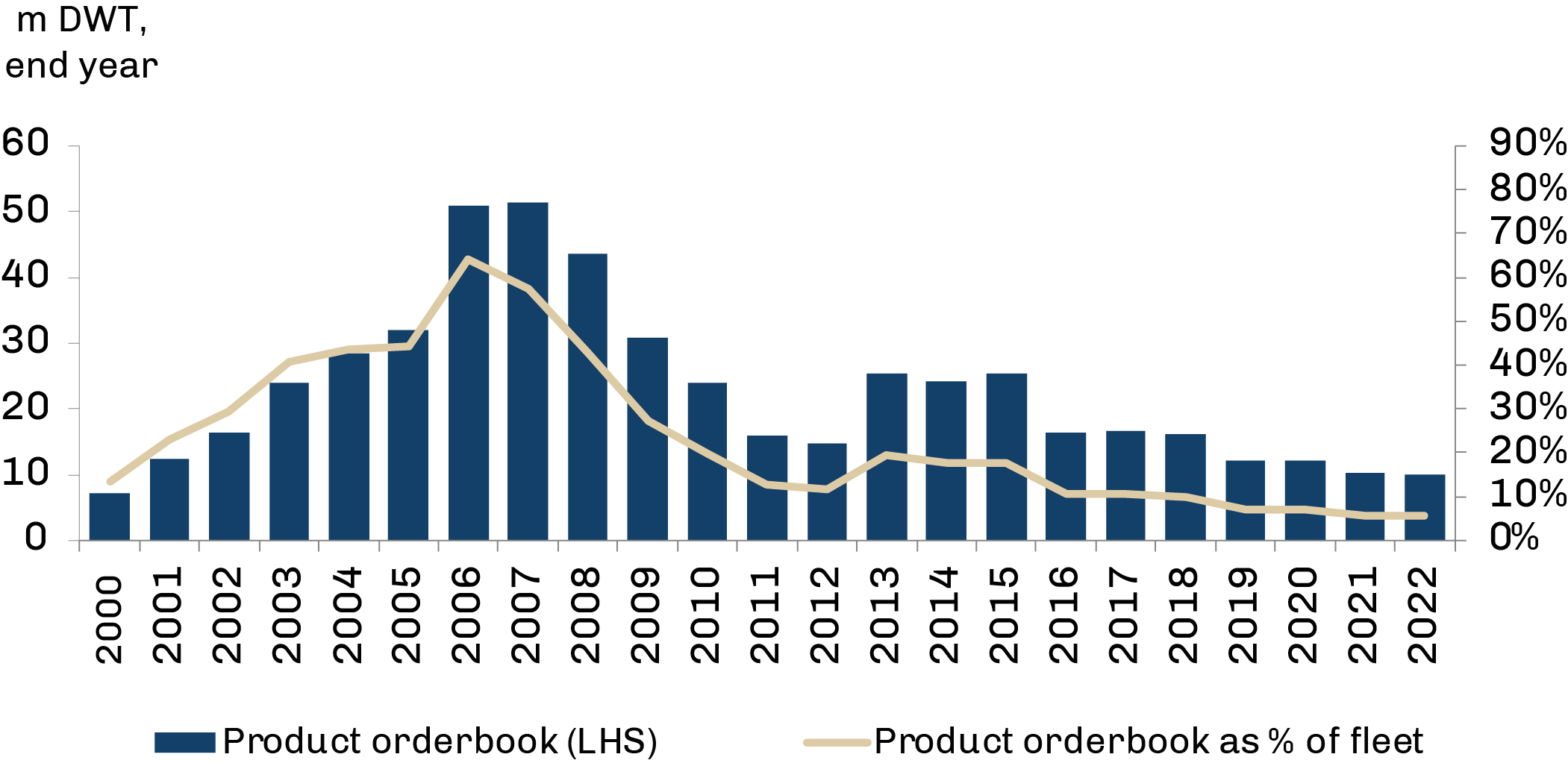

This is directly related to exceptionally strong market conditions, and a large amount of second-hand sales into a growing fleet trading Russian oil products. Product newbuild contracting generally remained steady at moderate levels in 2022, with orders placed for 5.0m DWT, similar to levels seen across 2018-22, though still down 33% on the ten-year average.

This is mainly due to a high contracting level of other shipping segments such as container ships or gas carriers, rendering yards to be operating at near full capacity. By the end of 2022, the orderbook remained limited, standing equivalent to just 5% of the existing fleet capacity.

2022 has laid very strong fundamentals entering into 2023. Continued growth in oil transportation demand, driven primarily by the changes to oil trade flows because of the EU sanctions and embargo on Russian oil, effective from 5th February 2023, and continued dislocation between refinery production growth in the East and oil consumption in the West, leading to longer transport distances.

Product tanker orderbook development

Source: Clarksons Research, March 2023